PRODUCT

Smarter Biometrics, Stronger Digital Identity.

VIEW ALL

product finder

solution

case study

support

Company

Identifying the World. Easily, Securely.

years of solid experience

20+

.jpg)

400+

customised projects

EN

.avif)

In our brave new digital world, the term 'digital identity' is often tossed around in conversations about online banking, government services, or simply signing up for a new social media account. But beneath the surface of these routine interactions lies a transformative force — a digital engine driving equitable growth and inclusion in our increasingly connected society.

Digital identity, our virtual counterpart built from data and online interactions, is more than just a digital ID enabling us to gain access to a broad range of online services. It is the unsung hero, an integral infrastructure paving the way for governments and organizations to foster a more inclusive digital economy. From identity authentication for financial institutions to securing mobile devices, digital identities are at the heart of our shared digital future.

In this blog post, we'll go over the history of digital identity, its key components, and the critical role of innovative technologies like biometrics in improving digital identity enrollment and identification. We'll also discuss how our work in biometric solutions helps governments and organizations build foundational digital ID infrastructure, contributing to the global effort to make the digital world more secure and accessible to all. Let's get started!

At its core, a digital identity is a collection of electronically captured and stored attributes and credentials that uniquely describe a person within a digital system or network environment. It's the data-driven equivalent of your physical self in the digital world. The digital identities we possess enable us to carry out a plethora of activities in the virtual world, from accessing online services like banking and e-commerce, participating in the sharing economy, to interacting with government services and even social media platforms.

Now that we've defined a digital identity briefly, let's dig deeper and understand the key components that comprise the digital identity:

Personal information form the bedrock of your digital identity. They are pieces of information that you use to identify yourself in the digital realm - the virtual equivalent of your name or date of birth. These can include:

These personal identity data play a critical role in creating your unique digital footprint in the vast landscape of the internet. They can then be further augmented with supplementary information like biometric data, such as facial recognition or fingerprints. Taken together, they provide a fuller and more secure digital identity.

A vital aspect of your digital identity is your digital credentials - the proof of your identity in the virtual world. Much like your physical driver’s license or passport, these digital identity credentials are issued by trusted entities such as a governmental institution or financial institution to confirm your identity and grant access to online services. These can include:

These credentials, when linked to your digital identity, offer a robust method of identity verification, adding another layer of trust to your digital persona. Depending on the type of credential, they may also be used for authentication or authorization (like a digital signature).

Biometric identifiers are the most unique and secure type of identifying information available. It holds the potential to revolutionize digital identity by providing a reliable, non-repudiable way to identify individuals both quickly and accurately. Biometric data can include unique physical or behavioral attributes, adding another layer of trust and security to our digital identities. Common types of biometric data used in digital ID systems are:

Biometrics is now playing an integral role in improving the overall security and privacy of digital identity systems, as well as offering a more convenient form of verification and authentication. This is why governments and organizations are rapidly adopting biometric technologies for their digital identity management solutions.

Digital behavior is a collection of data points that evolve with your online interactions, painting a more dynamic picture of your digital persona. This encompasses the activities you engage in online – everything from web browsing activity to online transactions and purchasing behavior. These can include:

Digital behavior when combined with digital IDs can provide a powerful tool for more accurate identity verification, identity fraud prevention, and risk management. Organizations can now use this data to build a comprehensive profile of an individual, adding another layer of trust to the digital identity.

So, when we talk about a 'digital identity', we are referring to a comprehensive, multi-dimensional construct that brings together personal identifiers, online behavior, digital credentials, unique biometric data, and insightful behavioral analytics. Together, these elements make a detailed and nuanced digital portrait of an individual in the online world.

To better understand digital identities, we must also explore the mechanics of managing and utilizing them effectively. These involve three critical processes that guarantee the secure and accurate use of digital identities: Identification, Authentication, and Verification.

This process represents the birth of a digital identity. It's the phase where a user willingly shares their data to register for online services, creating their unique digital identifiers. This process is like a welcome party where the user's unique characteristics, digital credentials, and even biometric identifiers are gathered, generating a unique digital footprint for our digital explorer in the online world.

This is the process of confirming that a digital identity corresponds to the actual individual in the real world. Trusted documents, such as driver's licenses, passports or national digital identity cards, are commonly used for this. Increasingly, advanced biometrics are also utilized, offering a more secure method of verification.

Once a digital identity is enrolled and established, its authenticity needs to be confirmed each time it's utilized. Whether it's accessing your mobile devices, logging into your online account, or verifying your identity to use financial services, authentication steps in like a trusted friend, ensuring that you are indeed the person behind your digital identity.

A banking eKYC example illustrating Identification, Verification, and Authentication:

Imagine you are opening an online bank account. Here's how the three processes unfold:

1. Enrollment: The bank asks you to provide personal information (such as name, date of birth, social security number, etc.). You also select a unique username and set a password. This process, akin to filling out your initial application, creates your unique digital identity in the banking system.

2. Verification: The bank then needs to ensure that the digital identity created corresponds to a real-world person. The bank cross-checks the information you provided (like the social security number) with external trusted sources or databases (such as a government database). If the information matches, your identity is verified. The bank may also ask for a scanned copy of your government-issued ID or use a video call for further confirmation.

3. Authentication: Now that your digital identity has been enrolled and verified, it needs to be authenticated each time you wish to access your online bank account. When you enter your username and password, the bank checks them against the details they have on file. If it matches, your identity is authenticated, and you gain access to your online banking services.

Now that we have unwrapped the building blocks of digital identity and the crucial processes involved in its management, let's turn back the hands of the clock and embark on a time-traveling journey. In the next section, we will delve into the fascinating history and evolution of digital identity. We will uncover how we arrived at the sophisticated digital identification systems of today. Stay tuned!

The Journey from Passwords to Biometrics and Decentralized Digital Identity

Going down digital identity memory lane is more than just a nostalgic trip; it's a fascinating journey that reveals how digital identities have evolved over time and shaped the digital landscape we live in today. Let's explore the rich history of digital identity, from the dawn of the digital age to the sophisticated multi-factor authentication methods we use today.

.jpeg)

In the early stages of computer science, the concept of digital identity was as simple as having a username and password. The limitations of technology at the time heavily influenced this strategy. Passwords were, and still are, the most commonly used form of digital identity authentication.

As technology advanced and networked systems emerged, the need for a more robust form of digital identity evolved. To access different systems within a network, users needed to authenticate their identity for each system, leading to a multitude of usernames and passwords.

%2520Concept.jpeg)

The concept of Single Sign-On (SSO) emerged as a solution to the burgeoning issue of managing numerous passwords. SSO systems allowed users to authenticate their identity once and gain access to multiple systems within a network. This represented a significant step towards simplifying access management.

As the digital world expanded, so did the security risks. This led to the evolution of multi-factor authentication (MFA), which provided an additional layer of security. MFA relies on two or more pieces of evidence, or factors, in the authentication process, combining something a user knows (like a password), something they have (like a mobile device), and something they are (like a fingerprint).

The advent of biometric technology marked a seismic shift in the digital identity landscape. This technology introduced a new form of digital identifier: unique physical or behavioral characteristics, such as fingerprints, facial features, voice patterns, or keystroke dynamics. Biometric identifiers offer greater security benefits as they are difficult to fake, steal, or replicate.

Biometrics also provide a level of convenience unmatched by previous methods, as users don't need to remember complex passwords or carry physical tokens. Biometric technologies continue to evolve rapidly, offering diverse applications in various sectors from banking to law enforcement, healthcare, and government services. The introduction of mobile biometrics, such as fingerprint recognition on smartphones, has made biometric technology an increasingly prevalent feature in our everyday lives.

{{product-cta}}

As we forge ahead, digital identity stands at an exciting crossroads, poised to become more user-centric than ever. We see emerging concepts like decentralized digital identities and self-sovereign identity, ushering in a new era where individuals have unprecedented control over their own data.

Decentralized digital identities represent the future where users own their personal data, distributed across numerous sites or devices instead of a central repository. This architecture not only bolsters privacy and security but also permits users to dictate the facets of their identity they wish to disclose. Combined with biometric technology, this approach ensures robust authentication while preserving the user's control over their personal biometric data.

Meanwhile, self-sovereign identity allows individuals to control their digital identities without intermediaries. The fusion of this model with biometrics signifies an era where individuals possess their identity data - including biometric data - and can decide how, where, and with whom they share their information.

As blockchain technology continues to evolve and integrate more deeply into our digital lives, these decentralized and self-sovereign models combined with biometric authentication are poised to become the new norm, strengthening the pillars of trust, security, and user control in the digital identity landscape.

Digital identity revolutions have significantly changed our digital interactions. These changes prioritize security, privacy, and individual empowerment. As we continue to explore digital IDs, let's focus on their real-world applications. We will look at how digital identities are used practically and draw inspiration from these examples.

The potential applications of digital identities are as varied as they are numerous. From financial services to healthcare, government services, and beyond, digital identities are transforming how we interact with the world. Let's look at some key applications of digital identity and how it has been instrumental in shaping our digital lives:

With the advent of the digital era, countries worldwide are leveraging digital identity act to revolutionize the interaction between citizens and government. National Digital Identity (NDI) systems have emerged as a robust tool to streamline governmental processes, enhancing efficiency, reducing bureaucratic red tape, and improving the delivery of public services.

Let's examine how different countries have embraced and shaped their unique digital identity infrastructures.

India’s Aadhaar program, one of the world's largest biometric databases, has radically changed the country's identity landscape. Issued by the Unique Identification Authority of India (UIDAI), the Aadhaar number is a unique 12-digit identity number based on an individual's biometric and demographic data. It’s used for:

In Africa, Nigeria is leading the way with its National Identification Number (NIN) system. The NIN, a unique set of 11 numbers assigned to each citizen and legal resident, is a vital part of Nigeria's National Identity Management Commission (NIMC) strategy to create a national identity database. It’s used for:

Singapore's SingPass (Singapore Personal Access) is a digital identity that citizens and residents use to interact with over 60 government agencies. SingPass users can access a multitude of services, ranging from income tax filing to checking Central Provident Fund (CPF) account balances. Recently, Singapore has also introduced facial verification as part of its national digital identity initiative.

Estonia stands out as a global frontrunner in implementing a comprehensive national digital identity system. Its e-Residency program allows global citizens to start and manage businesses in Estonia, entirely online. Every citizen is also provided with a digital ID card, used for:

Digital identity has come to the fore in the financial world, laying the groundwork for a seamless and secure digital banking experience. It acts as a key enabler in mitigating risks, ensuring compliance, facilitating transactions, and promoting financial inclusion. Here’s how:

The use of digital identities in electronic Know Your Customer (eKYC) processes has significantly simplified and sped up the customer onboarding process for banks and financial institutions. By leveraging digital identity systems, they can efficiently verify and validate the identity of their customers, reducing the risk of identity fraud and meeting stringent Anti-Money Laundering (AML) regulations.

For instance:

Unique digital identifiers, coupled with multi-factor authentication (including biometrics), provide a robust layer of security, ensuring that only the authorized individual can initiate and complete a transaction.

For instance:

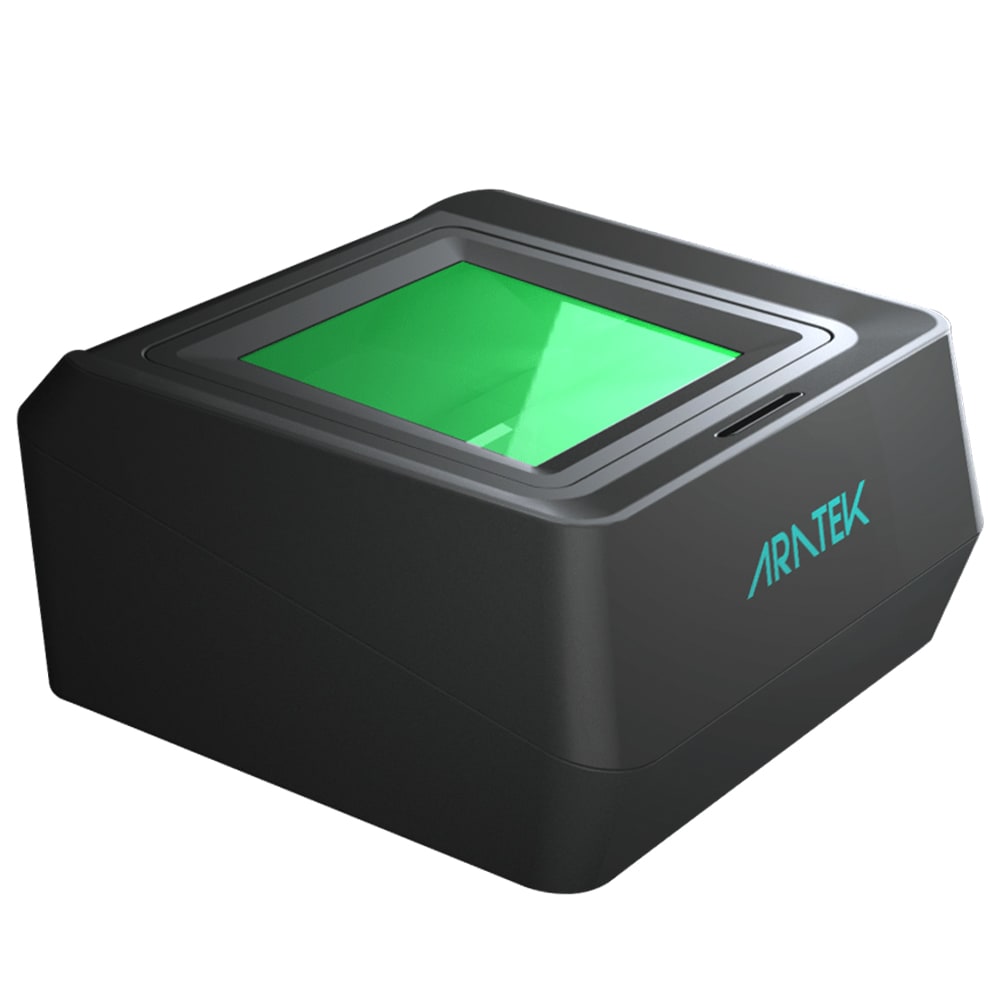

Digital identity is a powerful way to help people who don't have bank accounts or don't use them enough get access to financial services, especially in rural areas. Users can sign up and verify their identities digitally with the help of eKYC technology and biometric devices like mobile ID terminals or fingerprint scanners. This lets them create online accounts without having to bring in paper documents or go to a branch. This enables them to easily access financial services and other benefits, expanding their economic opportunities.

For instance:

Digital identities are the backbone of digital wallets, mobile banking, and Fintech innovations. They not only enable users to access banking services anytime, anywhere, fostering convenience and real-time banking, but also facilitate the development of innovative Fintech solutions.

For instance:

E-Commerce is one of the major applications of digital identity, improving user experience, security, and trust in online transactions. Here's how digital identity is shaping the future of e-commerce:

With the aid of digital identity solutions, e-commerce platforms can streamline the user experience. Instead of typing in lengthy personal information and payment details every time, digital identities allow for quicker and more convenient transactions. This simplification ultimately leads to higher conversion rates and customer satisfaction.

For instance:

Digital identities are invaluable tools in preventing online fraud. By analyzing data associated with a user's digital identity, such as IP address, device ID, and online behavior, e-commerce platforms can detect unusual patterns and potentially fraudulent activities.

For instance:

Digital identities can be a rich source of user behavior and preference data, enabling e-commerce platforms to deliver highly personalized shopping experiences. Online retailers can use the data related to search history, purchase history, and browsing patterns tied to a user's digital identity to offer personalized product recommendations, deals, and advertisements.

For instance:

Digital identity solutions can also help e-commerce businesses comply with regulatory requirements, such as age verification for certain products or Know Your Customer (KYC) regulations. By ensuring that they're dealing with verified individuals, businesses can build trust with their customers and regulators.

For instance:

As we've explored in this section, digital identity serves as a powerful, transformative tool across a range of sectors, from banking and government to e-commerce. These applications showcase the versatility of digital identity, underlining its potential to revolutionize how we interact with the digital world.

However, beyond these practical applications, why digital identity matters in today's word? Why should organizations care about it? And most importantly, what benefits does it bring to individuals, businesses, and society as a whole?

In the next section, we'll go through the various benefits of digital identity and why it's becoming increasingly crucial in our fast digitizing society. Keep an eye out!

As we've discussed throughout the article, digital identity has firmly planted its roots in our increasingly digital lives. But why does it matter? What significance does it hold in our world today? To answer these questions, let's explore the far-reaching benefits digital identity brings to our personal lives, businesses, and society at large.

Digital identity represents a robust line of defense in the battle against online fraud and cybercrime. The significance of security cannot be overstated in today's interconnected world, where a breach can lead to substantial personal, financial, and reputational damage.

In our fast-paced digital society, convenience is key. Digital identity significantly streamlines and simplifies interactions in the digital world, making life easier for both individuals and businesses.

Digital identity matters because it ensures nobody gets left behind. It has the power to bring financial services, healthcare, education, and more to those who have been traditionally underserved.

Digital identity drives economic progress in today's world, not just as a tool, but as a cornerstone of the digital economy. It facilitates innovation and technological advancements that fuel new business models and growth.

Digital identity interoperability — the ability for digital identity systems to work together across different regions, industries, and technologies — is indeed a vital benefit in today's globally connected world. It underscores the importance of digital identity and why it matters.

Last, the evolution of digital identity systems also brings about enhanced living standards and offers unique solutions to meet the demands of our changing society, benefiting individuals, organizations, and governments alike.

For Individuals

For Organizations and Governments

In essence, the advent of digital identity is more than just a shift in technology; it's a transformation that impacts how we live, work, and interact in a digitized world. The benefits of digital identity underscore its crucial role in shaping our present and future digital experiences. From securing online transactions and enhancing user experience to enabling financial inclusion and fostering interoperability, the potential of digital identity is truly vast and transformative.

In an era characterized by rapid digitization and interconnectivity, the value of a secure and reliable digital identity cannot be overstated. It serves as the linchpin of our digital lives, enabling a myriad of transactions, interactions, and innovations that define our modern society.

Yet, the journey of digital identity is still unfolding. As we stand on the cusp of new advancements, our challenge and responsibility is to shape these technologies in a way that upholds the principles of privacy, inclusivity, and user control. For digital identity to truly unlock its potential, it must be developed and deployed with a commitment to these principles.

The conversation around digital identity is far from over. As we continue to explore its capabilities, its impact on our lives and the global digital landscape will become increasingly significant. As such, we must embrace digital identity not as a mere technological tool, but as an integral part of our shared digital future.

So, let's continue to explore, understand, and shape digital identity — to foster a digital world that is secure, inclusive, and built for everyone.

.avif)

Use our product finder to pinpoint the ideal product for your needs.